in: Acumatica Tips & Tricks, Acumatica, Company News

Continuing our payroll edition, we are going to learn about Earning Type codes in Acumatica. These codes help organizations record hours and earnings information for employees. In Part One of this tutorial, we will provide an overview of how earning type codes work.

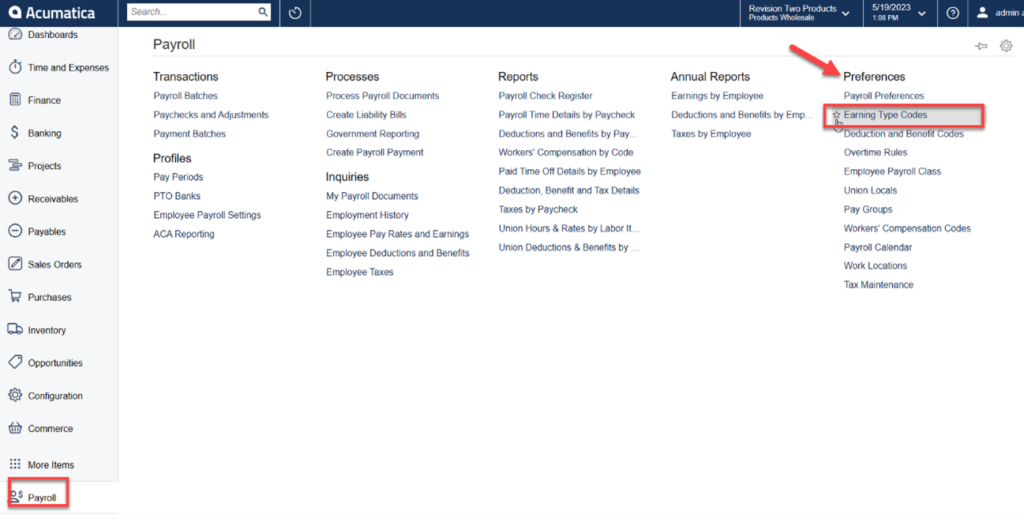

Acumatica Payroll

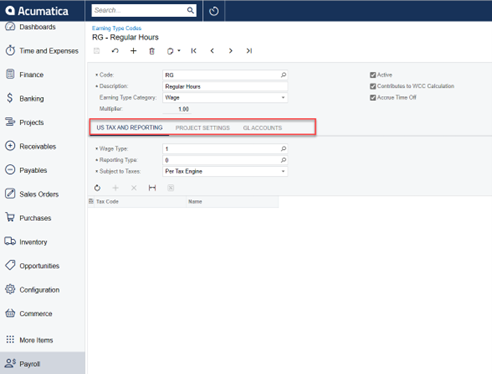

Start Acumatica and navigate to Payroll → Preferences → Earning Type Codes.

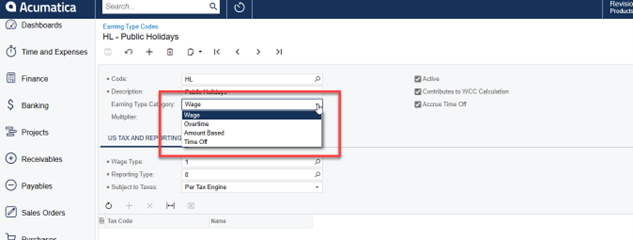

The system recognizes the following categories of earning types:

- Wage: An earning type of this category is processed as a normal earning.

- Overtime: The system processes an earning type of this category as overtime.

- Amount Based: Earning types of this category are amount-based, usually commission.

- Piecework: An earning type of this category is processed as a piecework. That is, the system calculates earned amount by multiplying the rate by the number of units instead of hours. This type of earnings is not included in overtime calculation.

- Time Off: Earning types of this category are processed as time off. For a Time Off earning type, you need to specify an earning type to be used as the source of the pay rate.

Earning types can be created by using the Earning Type Codes form. Earning types of the Piecework category can be created only if the Enable Piecework as an Earning Type check box is selected on the Payroll Preferences form.

(From Acumatica Help Resource)

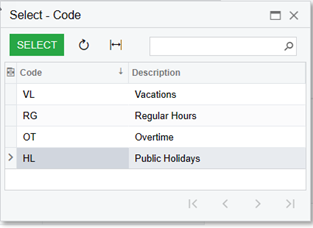

There are four predefined Earning Types by default in Acumatica.

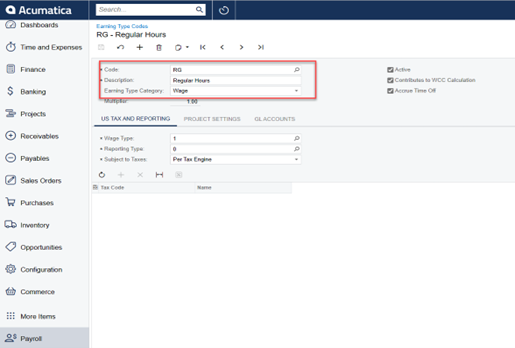

- Regular Hours (RG): Standard working hours that are paid based on the standard employee rate.

- Overtime (OT): Overtime working hours that are paid based on the standard rate multiplied by the value of the overtime multiplier.

- Public Holidays (HL): Non-working hours for public holidays, which are payable. You can use this earning type to indicate that certain days included in the paycheck are public holidays when no work is done.

- Vacations (VL): Non-working hours for vacations, which are also payable. You can use this earning type to indicate that the employee is on vacation and thus not working.

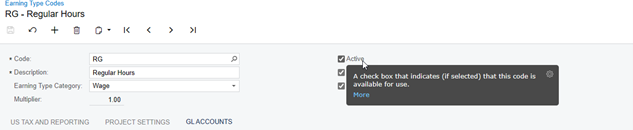

On our Type Codes screen, there are several fields for entering information. First, the Code and Description fields allow us to designate the Type Code needed with its designation. Also, the Earning Type Category is populated.

There are three (3) tabs under this section for taxes and reporting, project settings, and general ledger account designation. Each tab allows us to set the parameters needed for payroll processing.

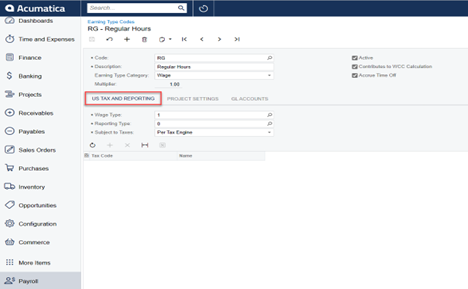

Under the US Tax and Reporting tab, we can:

- Indicate whether the earning type is to appear in Box 12 of the W-2 report and which code it will use.

- Specify the method used to determine the list of applicable taxes.

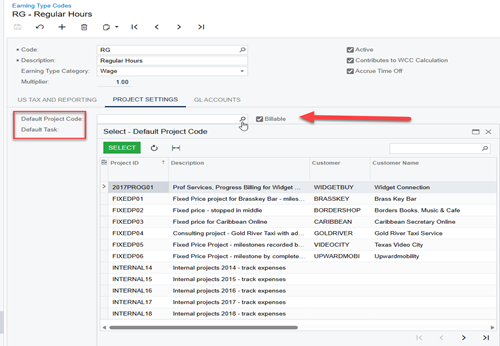

Under the Project Settings tab, we may:

- Specify a project and project task to be associated with the earning type code by default and designate its billable status.

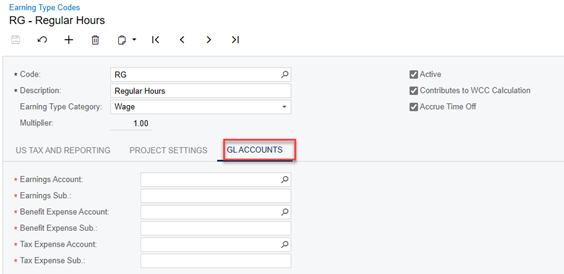

Under the GL Accounts tab, we will:

- Specify GL accounts to be used to record transactions linked with the earning type code. Note that each of these accounts is required to be entered.

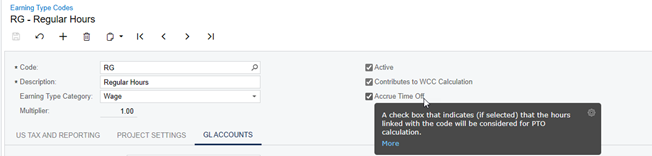

Finally, there are three checkboxes that allow for other parameters to be entered.

The Active box shows that a code is available for use.

The WCC calculation box indicates the Workers’ compensation class code to determine contribution to workers’ compensation depending on the category of work performed by the workers.

- The Accrued Time Off box indicates whether the hours linked with the earning type code are considered for PTO calculation.

This brief overview gives basic information on how Earning Type codes are used. In Part two, we will look at how to create and set up the different codes needed to process payroll in Acumatica.