in: Accounting, Acumatica, Company News

In this tutorial, we work through the steps of two processes: depreciating and disposing of a fixed asset on the company records. These are very simple processes that are further steps in managing fixed assets. First, we look at depreciation of an asset then disposing of another asset.

Acumatica Fixed Assets Module

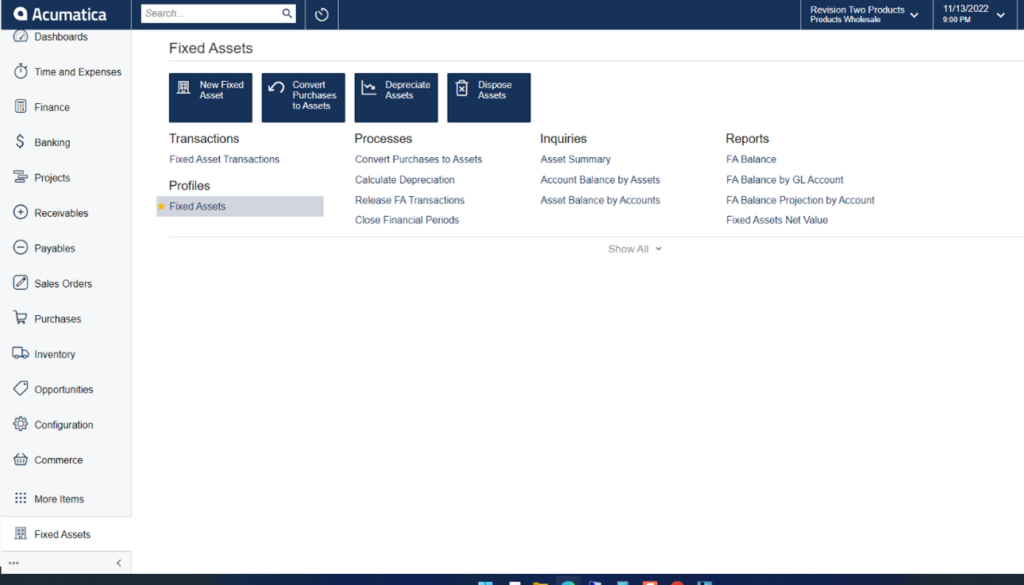

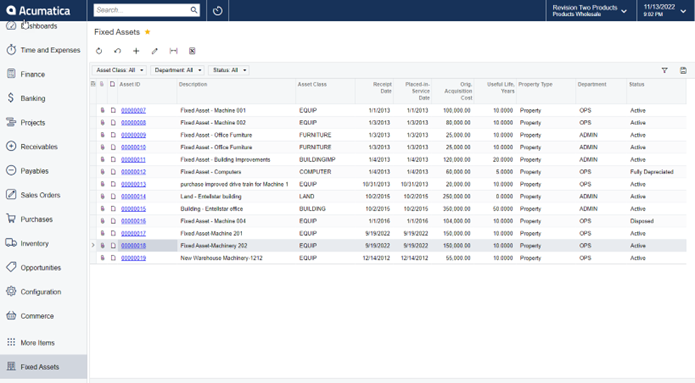

Start by navigating to Fixed Assets Main Screen → Profiles → Fixed Assets

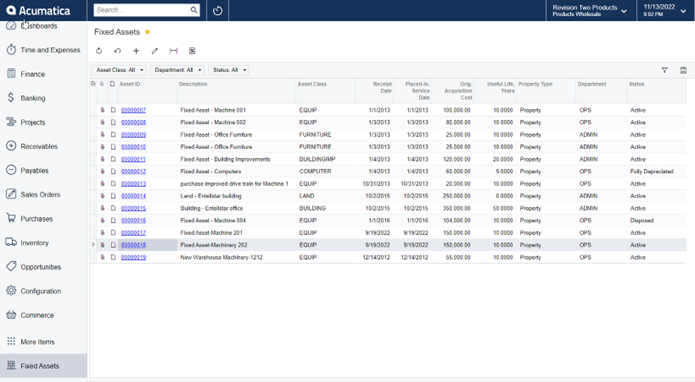

The next screen shows the list of fixed assets for the company. Select an asset to depreciate.

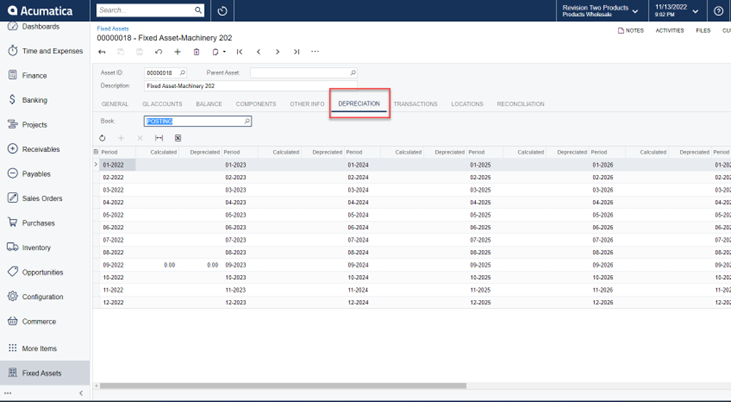

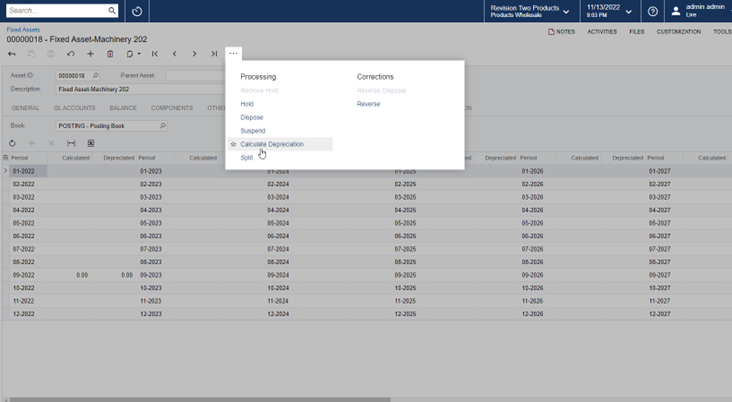

Click on the tab labeled Depreciation. Notice that there are no values listed—only dates. This screen is where the depreciation listing will be detailed once the process is complete.

First, we need to calculate the depreciation. To do this, click on the ellipsis in on the toolbar at the top of the screen. Select Calculate Depreciation by clicking on it.

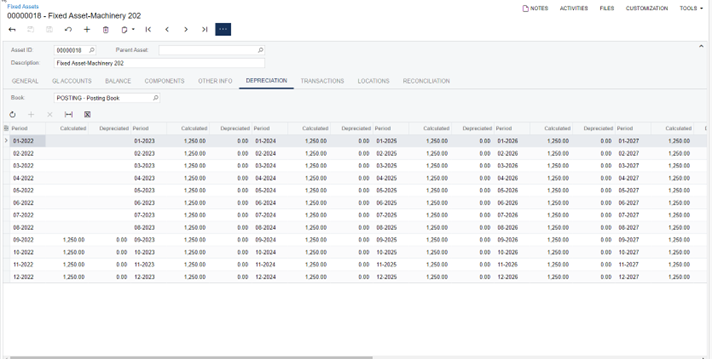

That’s it! Depreciation is calculated. Beginning from the date the fixed asset was put in service monthly, depreciation is calculated until the end of the useful life of the asset. Next, we will depreciate the asset to the current date.

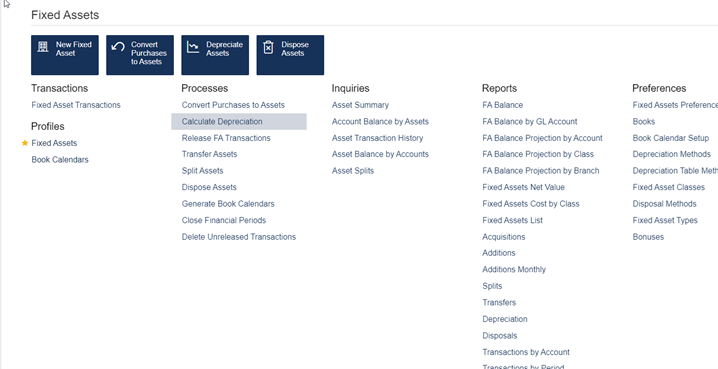

Navigating back to the main Fixed Assets screen, next select Calculate Depreciation under the Processes section.

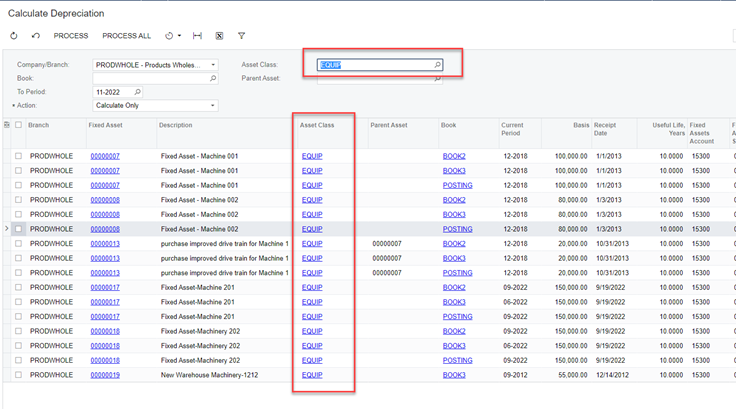

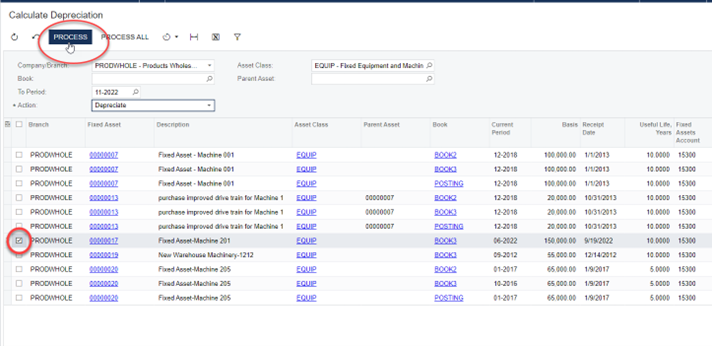

To simplify the search for the asset needed, select the asset class it belongs to. This will give you a list of only those types of assets to depreciate. Further, selecting the Book the transactions are associated with will give a specified list. From here, select the asset that needs to be depreciated.

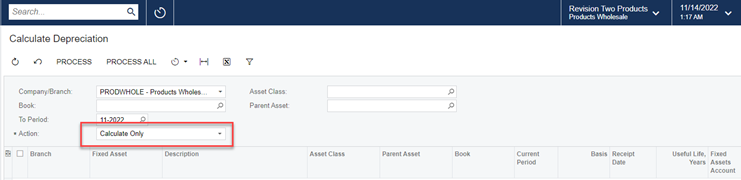

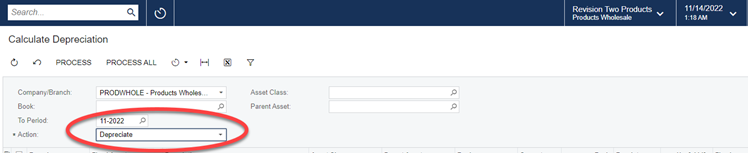

Notice that the Action (required) field has defaulted to Calculate Only; Change this to Depreciate.

Select the appropriate asset by marking the box next to it, creating a check mark. Then, click Process. A progress bar will appear in a new window. Once processing is complete, the record will be ready to release.

The next process we will complete is the disposal of a fixed asset. This, too, is a simple process utilizing the same screens as the depreciation. Select the asset to dispose.

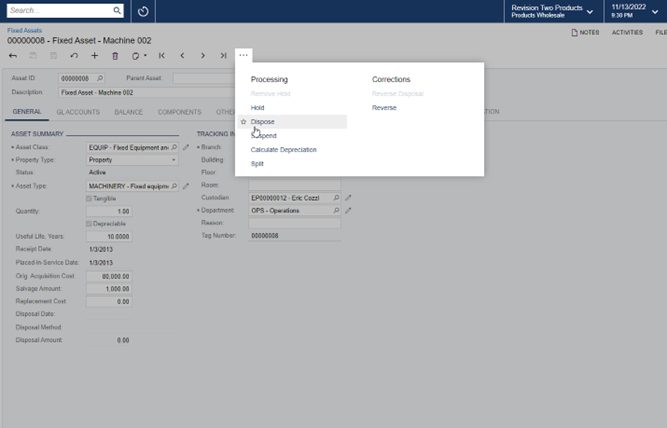

From the specified asset screen, click on the ellipsis and select Dispose.

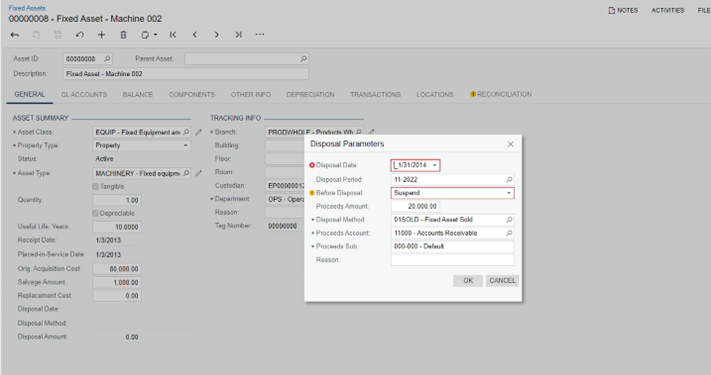

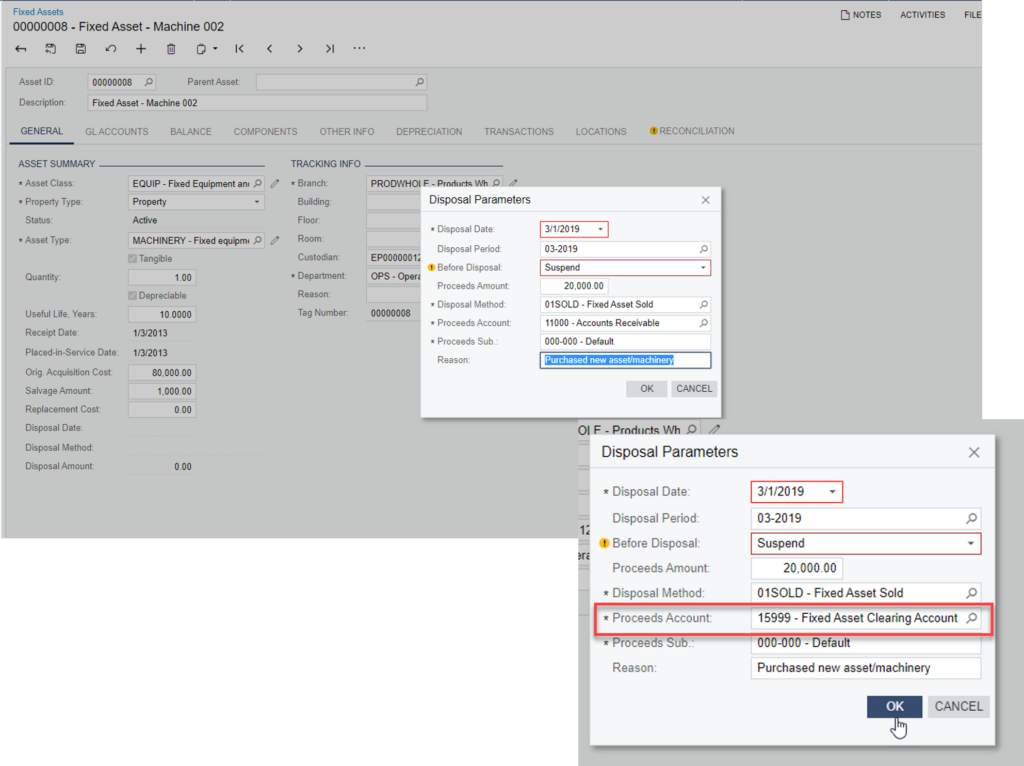

The Disposal Parameters screen is where we will enter all the needed information to properly dispose of the fixed assets on the company records. For this demo, the highlighted areas have been generated to show different circumstances of disposing of the fixed asset.

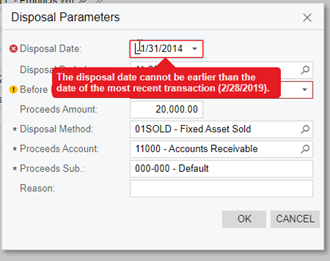

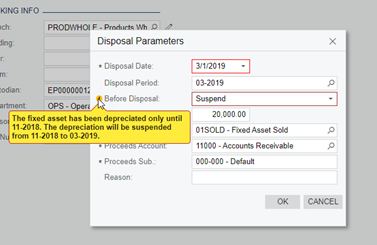

First, enter the disposal date (usually the current date). Note the highlighted message. It is a reminder of the parameters of the date requirements. In the Before Disposal field, there are two choices: Suspend or Depreciate. The system defaults to suspended. If the asset is out of service or no longer depreciable, it should be marked suspended. If the asset needs to be depreciated until the date of disposal, simply change the field to Depreciate. Per our records, the disposal date is 3/2019 with depreciation suspended 11/2018.

Next, enter any proceeds from any sales of the asset, disposal method, and account/subaccounts for the proceeds to be allocated to. These fields usually default to specific settings but may be changed, as necessary. Finally, enter a reason for the disposal and click ok when finished. This will process the disposal marking it ready to be released.

Make sure that the Proceeds account is not a control account. Otherwise, an error highlight will signal that it needs to be changed.

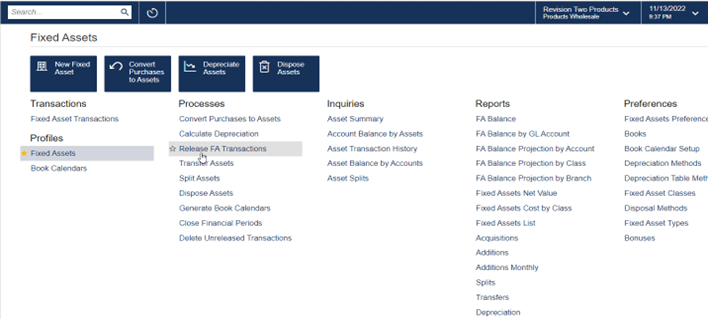

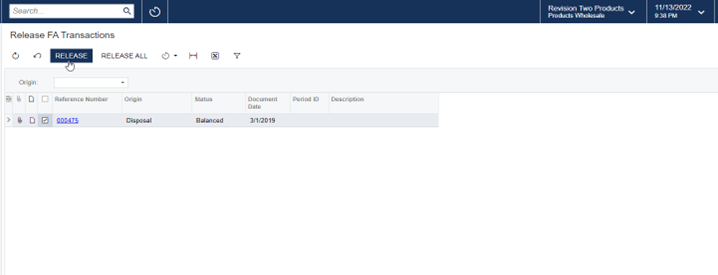

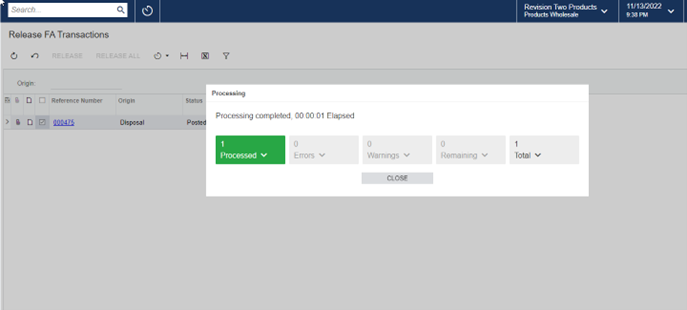

To complete both processes and release the records, post them to the accounts, navigate back to the main fixed assets screen and click Release FA Transactions. On that screen, select the transaction(s) needing to be released and click the appropriate button to release the transaction.

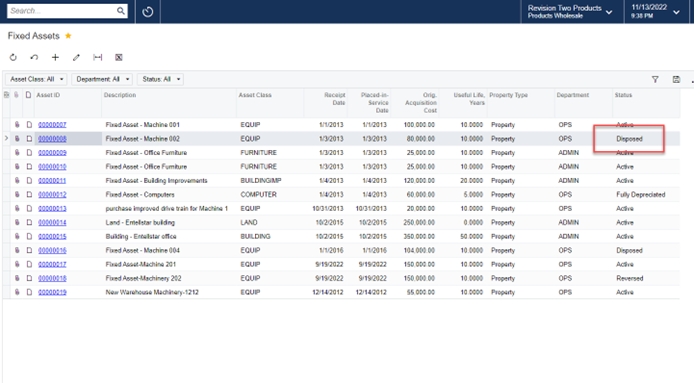

To check, navigate back to the Fixed Assets screen and note the status.